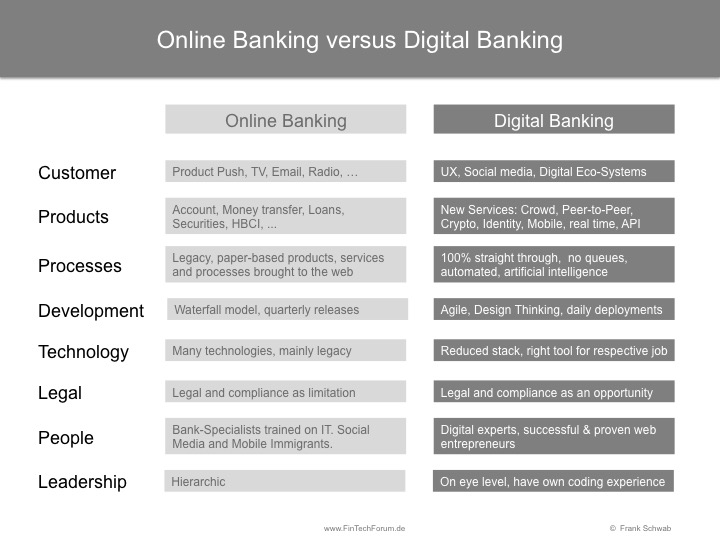

Is „digital” just another word for „online”?

Or is there a difference we need to understand?

Over the last 2 weeks more than 150 people provided feedback regarding my generic high level thoughts about (traditional) online banking versus digital banking. This post reflects the feedback I got and an updated thinking.

While there are more dimensions to consider I limit myself to the 8 most important ones:

Customer first

It all starts with the customer. Decades of high margins and profits made most traditional bankers and banks lazy. Instead of caring about the customer many banks cared about themselves, in the first place. While traditional online banks successfully pushed their products via TV, newspaper, branch staff, radio, Email, web site … to the customer they forgot about customer needs.

In contrast emerging digital banks focus mainly on digital customers and their needs, like high convenience and usability across digital devices and channels. Digital banks care about digital eco systems for a high digital customer experience and build digital products and services. Examples in retail banking are moven, simple, Fidor and Number26.

New digital products

To abandon product push and to focus on the digital customer does not mean digital banks do not need to care about products.

Digital banks enhance traditional products like account, money transfer, loans, securities by new products, services and convenient access channels like crowd, peer-to-peer, crypto, real time and API access.

Automated, straight through processes

Banks are early users of computer technologies and they have invested hundreds of billions of EUR and USD over the last 50 years. Many bank processes are still based on legacy hardware and software capabilities and designed for bank branches primarily. In the last 15 years traditional banks brought many of the legacy and paper-based products, services and processes to the web with minimal adaptions. This is the current state of online banking of traditional banks.

In contrast digital banking deploys processes that are specially designed for the web: 100% straight through, no queues, automated and with significant analytics and artificial intelligence capabilities. This enables e.g. international value transfers in seconds rather than hours or days. Ripple, Ethereum, Blockchain and Bitcoin are early providers and inventions we can observe.

Faster development

Traditional online banks mainly use traditional development models. E.g. the waterfall development and quarterly deployment releases are still predominant. This does not fit in the faster changing business environment banks live in. Actually such approaches demotivate talented IT people. And they are expensive, e.g. with respect to test efforts and results.

However digital banking companies develop agile, make use of design thinking, think about MVPs and deploy their software on a daily or weekly basis. This allows them to improve and adapt customer experience fast and to keep pace in the new highly competitive market place.

Right technologies

In most traditional banks technology is still striking. Given the age of their IT systems you will find any technology of each and every decade – from Cobol and IBM mainframe via Smalltalk and Unix server to Java and Intel grids. At the same time there are plenty of hardware and software instructions many IT people are not aware of. Overall traditional online banks are confronted with a mess of legacy technologies.

On the other hand the attackers – NewBanks and FinTechs – build their digital banking business models on a green field and from scratch. They can work with a reduce technology stack and can apply the right hardware and software tools for the respective specialized IT jobs. This attracts IT talent, too. As a consequence digital banks achieve high usability, high system performance, high scalability and low IT cost per user.

Legal opportunities

While most online banks applied many additional rules and procedures on top of existing laws digital banks search for minimum standards and gaps to compete with the incumbents. In some cases the new players stretch existing laws, test existing constraints and foster new laws. Digital signatures, digital contracts and virtual currencies are some examples where we see new laws.

Digital natives

There are still many bank specialists who are trained on IT who work for traditional banks. As of today, many of them are in management positions and still lack the basic understanding of IT and the underlying concepts and dynamics. Internet, social media and mobile are foreign technologies and foreign behaviours to them – it is what their children are doing. Actually many IT specialists in traditional banks manage IT, they do not build it. Most are also social media and mobile immigrants! This is reflected in the current state of online banking of traditional banks.

In comparison digital banks hire digital natives – mainly. Actually they look for people who mastered the implementation of successful web business models, already. They look for real IT experts and nerds who never experienced a world without the Internet. Digital banks look for people who care about UX, speed, automation and scalability.

New leadership

Hierarchical organization models are the predominant way to run a traditional online bank. Most leaders of online banks do not have own coding experience and do not really understand how to create a pure digital bank business model across all functions, especially when it comes to digital customer engagement, UX, digital products and the underlying technology.

In contrast digital banks hire digital savvy leadership teams. Hierarchies are flat. Trail and error are accepted. Most of the leaders have a good own understanding of the digital customer, can envision digital banking products and have own coding experience. Technology is handled on eye level.

Frank Schwab, Co Founder FinTech Forum